By Lou Covey, Editorial Director

Judging from the number of companies that exhibited at the Intersolar/EES joint conference in San Francisco, energy storage is the next big thing in green energy. It resolves the problem of intermittent over-and under-production that plagues sources like solar and wind. It comes, however, at a high cost to the pocketbook, the environment and personal safety. The good news is that there are alternatives to conventional storage technology. The bad news is those technologies are only now coming to market and are facing an uphill battle with the technology status quo.

First, let's look at the most popular technologies dealing with storage and why storage is even necessary in the first place.

Wind and solar are the most popular sources of green energy today, but they are also two of the most inconsistent, inefficient and costly sources of electricity. Wind only produces power when the wind is blowing and only at a narrow range of wind speed. If the wind blows too fast or too slow, your wind turbine becomes, essentially, useless. Solar produces power most effectively between the hours of 11 a.m. and 4 p.m. which just happens to be the same off-peak hours when less electricity is needed. Production from solar panels disappears during peak demand times. Adding a storage technology allows systems to save up electricity during peak production times providing "clean" power during peak demand. Because most systems are designed to store between 48 hours to a week of electricity without recharge, they also serve as a valuable source of energy when the wind doesn't blow or the sun doesn't shine.

The two most common forms of storage technology are lead-acid batteries, similar but larger than the kind of batteries in internal combustion cars, and lithium-ion (Li-ion) batteries, like those used in electric and hybrid cars and mobile devices. The average lifespan for these two popular technologies is about 10 years. That's where cost comes in as a significant factor.

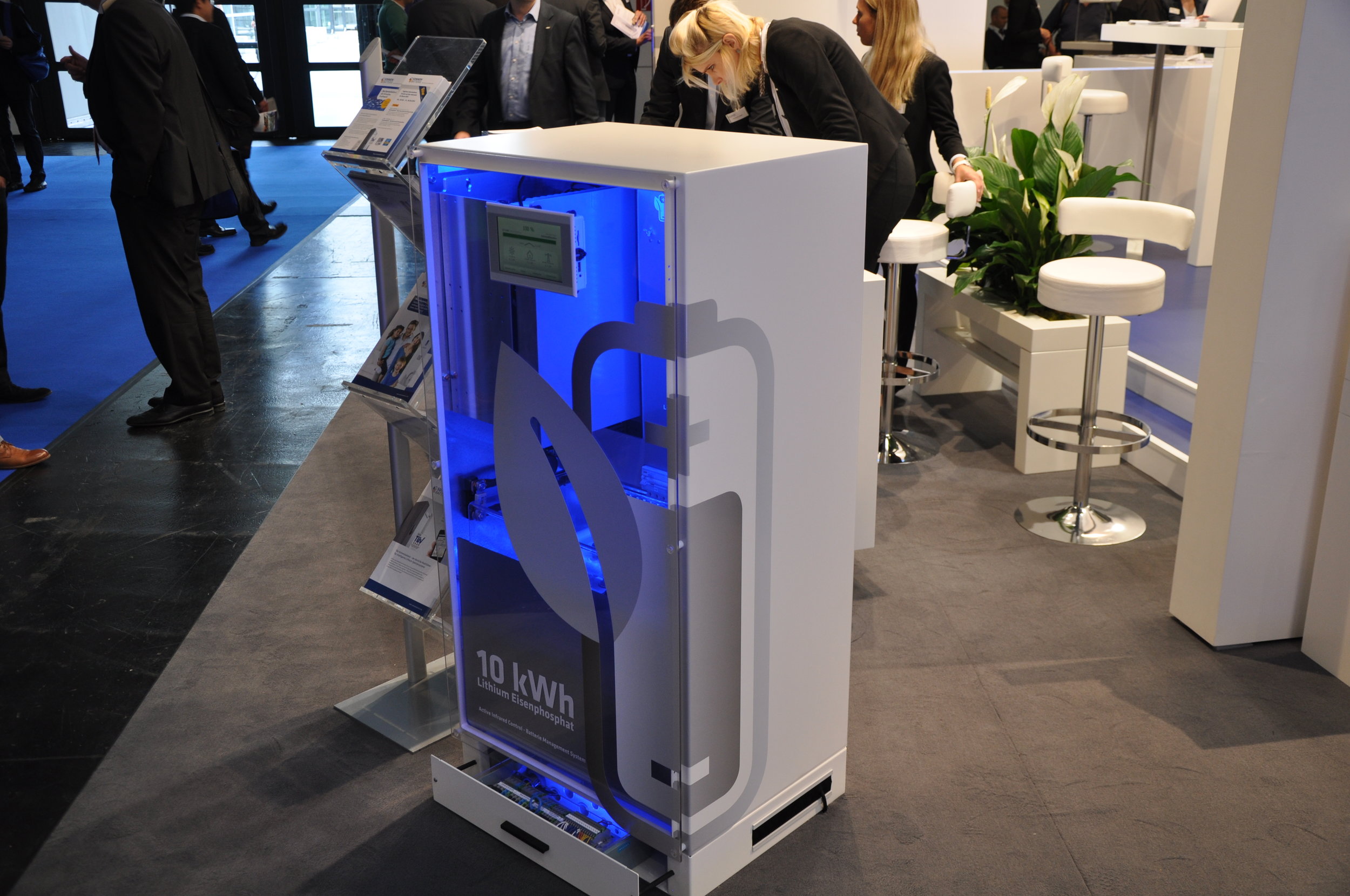

Since windmills and solar have a stated maximum-generation lifespan of 20 years it means the batteries must be replaced or enhanced at least once during their lifetime (just like you do in any other device) long before the generators die. Both technologies require significant and sophisticated hardware and software technology to charge, maintain and manage the flow of power efficiently and safely. When you combine all that together you get a cost of $1000-$2000 per kilowatt/hour. The average system needs to hold a minimum of two days worth of power, so a 5 kW/hr solar storage product will cost between $10,000 and $20,000 for 10 kW of storage. That's added on top of the $30,000 the energy system cost, and, as stated, it will have to be completely replaced at least once during the life of the energy system. The minimal cost for energy storage, then, is more than half of the cost of the energy system. Even with subsidies that puts the cost of green energy out of the hands of many residential and commercial users. Storage systems have other significant costs that should not be overlooked.

Now let's consider the environmental costs.

Stationary lead-acid battery system (SLABS) have a significant list of environmental compliance, enforcement, and liability concerns because the active ingredients are sulfuric acid and lead -- two of the most toxic substances on earth. A spill may result from the improper handling of hazardous material discharge or a slow and undetected corrosive breach in the battery housing that can cause injurious, if not lethal exposure to employees, workers, or tenants. Overcharging a battery, due to a failure in the software control system, can result in the release of hydrogen sulfide gas, a colorless, poisonous, flammable substance that smells like rotten eggs.

Lead is highly toxic metal and once the battery becomes inoperative, it must be properly collected and recycled. A single lead-acid battery disposed of incorrectly into a solid waste collection system, and not removed prior to entering a resource recovery facility for mixed waste, could contaminate 25 tonnes of waste and prevent the recovery of the organic resources because of high lead levels.

Sixty-four percent of all the lead produced through mining goes into lead-acid batteries and the harmful effects of improper recycling are giving (even in third-world countries where regulations are less stringent) pause in using them from energy storage. The government of India is mandating the elimination of the technology for anything but automotive use. The reason for the ban is that lead from storage batteries placed in unlined landfills is contaminating groundwater.

Lithium Ion

Li-ion batteries have advantages over lead-acid in that they are smaller and lighter making them preferable to electric cars and mobile devices, but they are in their relative infancy in large-scale use.

“We are at the very beginning in energy storage in general,” says Phil Hermann, chief energy engineer at Panasonic Eco Solutions. “Most of the projects currently going on are either demo projects or learning experiences for the utilities. There is very little direct commercial stuff going on."

Moreover, Li-ion is highly unstable and without proper power management, usually via a software solution, they tend to burst into flame (e.g. the hoverboard). Every vendor we talked to at the EES conference dismissed safety concerns, essentially saying that the problem exists with other vendors, not them.

One company, a start up called ElectrIQ Power, provides a turnkey system in a box including the batteries, inverter and control software, which is touted as their claim to safety superiority. Like all other Li-ion system suppliers the warranty for their systems is for 10 years. At that point the battery capacity is 60% of what it was when new, requiring the purchase of a new system or an additional 5 kWh booster pack at the end of the 10 year period.

However, at present they have no plans on helping customers deal with the disposal of the batteries at the end of their useful life. No other Li-ion vendor could answer questions about eventual disposal either.

Video: ElectrIQ Power simplifies home energy storage

Here's an interview with the founder of ElectrIQ Power:

Electric Power is a software company integrating and managing multiple energy storage technologies into a single unit. The system is based on standard Lithium-ion battery technology with hybrid investors.

But beyond safety, the environmental issues facing the production of LI-ion is most troubling. An EPA 2013 report concluded that batteries using lithium, nickel and cobalt, have the “highest potential for environmental impacts”. It cited negative consequences like mining, global warming, environmental pollution and human health impacts.

Take, for example, the Tesla factory near Reno, Nevada. As Nevada is the only source of elemental lithium in the United States locating the factory in that state was an obvious choice and the Nevada government has always been open to toxic industries. Elemental lithium is flammable and very reactive. In nature, lithium occurs in compounded forms such as lithium carbonate requiring chemical processing to be made usable. Typically found in salt flats in areas where water is scarce, the mining process of lithium uses large amounts of water. Toxic chemicals are used for leaching purposes, chemicals requiring waste treatment. There are widespread concerns of improper handling and spills, like in other mining operations around the world. Even in first world countries, Li-ion battery recycling is in the single digit percent range. Most batteries end up in landfill.

Finally, we have nickel-cadmium batteries (NiCd). This is a very old technology that has been in in commercial production since the 1910s. While not as expensive as Li-ion and have more recharging cycles, they are bulkier, have lower power densities, and must be completely discharged before recharging, They also survive longer then Li-ion and have not been know to explode when overcharged.

Ni-Cd batteries have been used early energy-storage applications. For example the 27 Megawatt wind farm operated by the Golden Valley Electric Association In Alaska has used a 3 Megawatt Ni-Cd system stabilization on the island of Bonaire since 2010. But their lack of density and the need to completely discharge power before recharge has made them less valuable to the renewable energy industry. NiCd mining and production is just as toxic as Li-ion and recycling is so toxic they have been banned in the European Union.

So, when it comes to adopting the most popular forms of energy storage in the world the question the market needs to answer is, "how much do we want to damage the environment for it?"

There are alternatives, though. We look at those next.

By Lou Covey

Editorial Director

By Lou Covey

Editorial Director